How to read your monthly processing statement

At Pepper Pay, we want your monthly statement to be a tool — not a puzzle. This guide breaks down the key sections of your processing statement so you can clearly understand your deposits, fees, and activity without second-guessing what you’re looking at.

Whether you're a new merchant or just want a refresher, here's how to read your monthly statement with ease.

Note: All examples in this section are not real data and were generated for educational purposes.

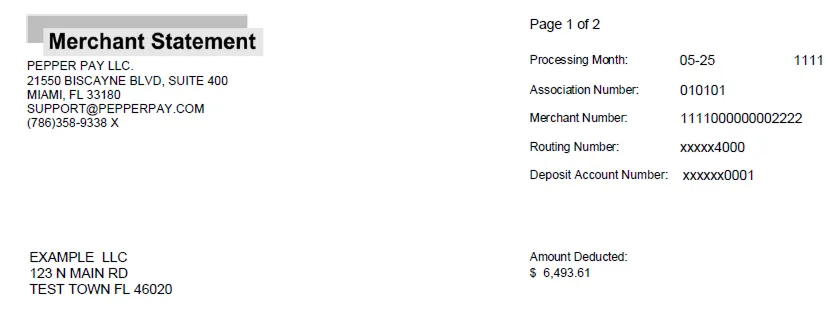

1. Statement Header

At the top of your statement, you'll find:

- Your business name and address

- Your merchant number and processing month

- The bank account(s) tied to your deposits and charges (masked for security)

- Your total amount deducted for the month (fees + discount)

This section confirms which account was used and how much in total was withdrawn to cover fees.

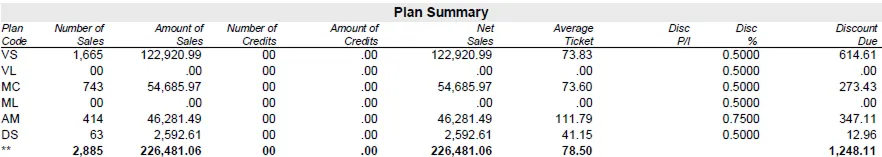

2. Plan Summary

This is a breakdown of your total card activity by brand, showing:

| Item | What it Tells You |

|---|---|

| Plan Code | The card type (e.g., VS = Visa, MC = Mastercard) |

| # of Sales | Total number of approved transactions |

| Sales Volume | Total dollar amount of those transactions |

| Credits | Number and amount of refunds (if any) |

| Net Sales | Total sales minus credits |

| Average Ticket | Average transaction size |

| Discount Rate | The rate applied (if on tiered or flat pricing) |

| Discount Due | Total discount charged for that card brand |

This section helps you see which card types drive the most volume — and how they affect your discount charges.

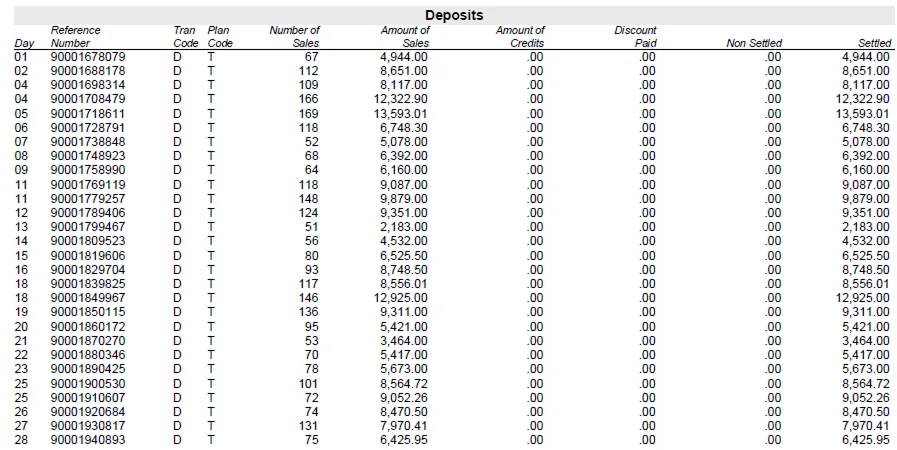

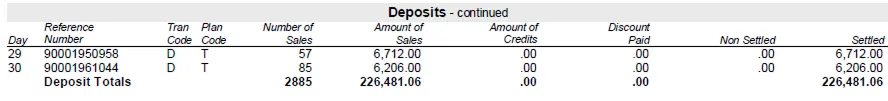

3. DEPOSITS

This section lists your daily settlement activity, including:

- Date of deposit

- Number of transactions settled

- Gross sales amount

- Net deposit (after daily discount if applicable)

If you’re on a daily net discount structure, the fees are deducted before funds are deposited. Otherwise, deposits are listed in full, and fees are deducted separately.

This section should match your bank deposits.

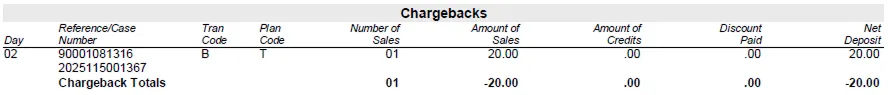

4. Chargebacks

If any chargebacks occur during the month, they’ll appear here with:

- Date

- Case number

- Amount

- Plan code (card type)

- Transaction code

This lets you easily track how much was debited from your account and on what date due to disputes.

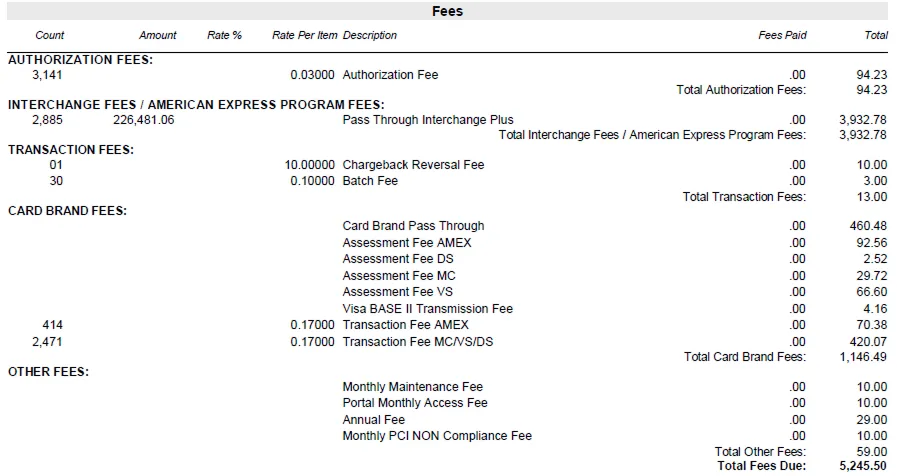

5. Fee Summary

This section outlines all processing-related fees charged by Pepper Pay during the month. Based on the example, these may include:

Authorization Fees - Charged per authorization attempt (even if not captured)

Interchange Fees (IC+ Plans)

- True cost passed through from Visa, Mastercard, Amex, etc.

- Varies by card type and transaction method

Transaction Fees - Flat charges per successful transaction

Card Brand Fees

- Includes assessments, network access, and per-transaction costs by brand

- Example: Visa BASE II, Mastercard NABU, etc.

Other Fees

- Monthly maintenance

- Portal access

- PCI non-compliance (if applicable)

- Annual fees

Note, fees can vary based on the signed merchant application.

6. Summary Totals

At the bottom of your statement, you'll see a recap of all charges for the month:

| Item | Description |

|---|---|

| Discount Due | Processing fees charged per volume |

| Fees Due | All service and network-related fees combined |

| Amount Deducted | The full amount withdrawn from your account to cover both |

Pro Tips from Pepper Pay

- Need fewer debits? Ask us about Monthly Discount or Net Daily fee options to streamline reconciliation.

- Want to split deposits and fees into two separate accounts? We support dual-account setups.

- Concerned about PCI or annual fees? We’ll review your account and help reduce avoidable costs.

- Not sure which pricing model you’re on? Just ask — we’ll clarify and recommend the best fit.

support@pepperpay.com; 786-358-9338 option 3