In-Store, Online, and Mobile Payments Made Simple

Today's customers rarely carry cash, and Pepper Pay ensures you're ready. Our all-in-one platform lets you accept every payment type with speed, security, and ease. From in-store to online and mobile, we provide the tools to keep your checkout seamless, your operations productive, and your customers loyal.

Start NowWe Are Here for You...It's That Simple!

POS Payments In‑Store

- Wide range of POS hardware tailored to retail needs

- End-to-end encryption, PCI-compliant security

- Contactless and tap-to-pay capabilities

- Flexible integration options

- Smart terminals designed for faster, more reliable checkouts

- Support for self-service kiosks and unattended vending

Mobile Payments

- Accept payments anywhere with wireless and mobile POS terminals

- Seamless integration with Apple Pay™, Google Pay™, and other digital wallets

- In-app and link-based payments for flexible, customer-friendly options

- Built for pop-ups, events, deliveries, and on-the-go transactions

Maximum Availability

- 99.99% uptime supported by redundant global data centers

- Real-time monitoring and live support

- Scalable infrastructure that grows with your business

- High-speed, secure transaction processing at any volume

We Make Payments Personal

We do things differently and that begins with our commitment to be there for you. Pepper Pay makes things happen, raising the standard for payment processing.

- Dedicated support team to assist you when you need it.

- Unparalleled acquiring flexibility.

- Advanced customization.

- Performance strategies.

- Real time support from real people, on your schedule.

State-of-the-Art POS for Every Retail Store

Pepper Pay's POS systems allow you to accept every payment type your customers prefer, quickly, securely, and reliably. Whether you run a small shop or a large retail chain, our technology ensures your checkout is seamless and scalable.

Accept Your Payments, And Support on Your Time

Retail-Focused Features

Integrate In-Store

Instant & Secure Payment Processing On-The-Go

From retail to restaurants, Pepper Pay gives you the flexibility to take control of your payment experience. Our solutions combine advanced technology with powerful analytics and hands-on support, ensuring your business runs seamlessly, wherever you sell.

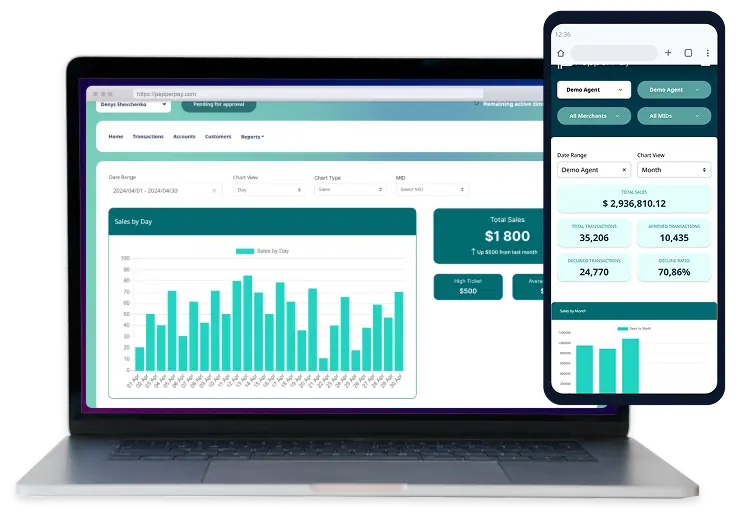

Create a truly seamless payments experience with centralized reporting and analytics. Save time and money by combining in-store, online, and mobile transactions into a single platform that simplifies your operations.

Enhance the checkout journey with EMV and NFC-ready POS terminals. Use Pepper Pay's advanced solutions to manage subscriptions, accept card payments at self-service kiosks, or transform mobile devices into secure terminals.

Accept payments anywhere - events, mobile sales, or in-vehicle - without compromising speed or security. Pepper Pay's mobile technology reduces communication costs while giving your customers a smooth, reliable experience.

Powering All The Ways Your Retail Store Does Business

Pepper Pay delivers flexible POS solutions designed to match every retail model—from countertop devices to tablet-based systems and wireless pay-at-the-table technology. Our platforms combine top-tier security with cost efficiency, giving your business the tools to grow while keeping operations seamless.

- Tailored POS for Every Business: Customizable hardware and software options that adapt to your store's needs.

- Simplified Billing: Streamlined tools that let you bill customers quickly and accurately.

- Customer-Friendly Checkout: Smart terminals that create faster, smoother payment experiences, encouraging repeat business.

- Third-Party Agnostic: Compatible with leading retail software, making integrations effortless.

And whether by phone, order form, or in-person, Pepper Pay ensures reliable solutions.