Fast, Secure, and Affordable Bank Transfers

Pepper Pay's ACH (Automated Clearing House) solution lets businesses accept direct bank transfer and eChecks with low fees and great reliability. From one-time payments to recurring billing and B2B transactions, our ACH platform makes moving money simple and cost-efficient.

Learn MoreWhy choose Pepper Pay ACH Solution?

Frictionless Checkout

Superior Security

Account Verification

Human Support

Secure, direct bank transfers for a seamless checkout experience.

Enhanced security with encrypted, direct, verified bank-to-bank transfers.

Bank account verification confirms fund availability to reduce fraud, chargebacks, and ACH rejects.

Real people available anytime, anywhere to help your business and your customers.

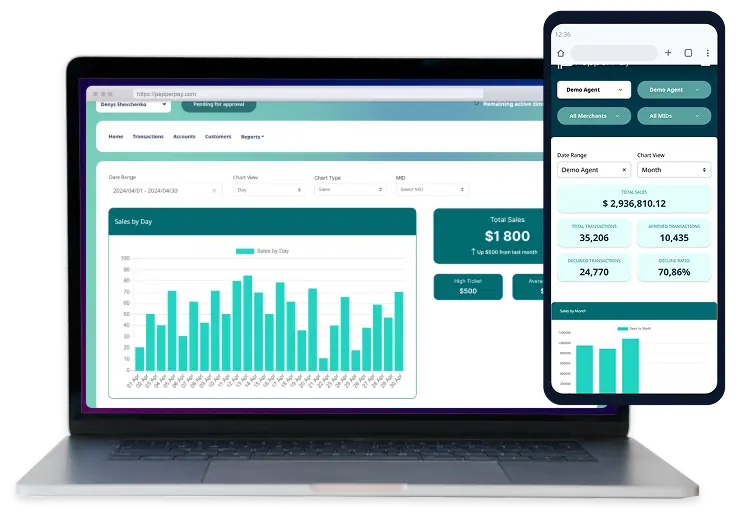

Prevent Costly Bank Transfer Returns

Bank transfer returns can create costly delays and extra administrative work for businesses. Our real-time data verification tools help prevent these issues and streamline operations.

Learn More