Eliminate Credit Card Processing Costs

Save on processing fees by enrolling with Pepper Pay's compliance driven programs. Our technology ensures fair, automated compliance while giving your business the freedom to reduce costs and maximize revenue. Reward your customers for paying with cash while saving on credit card processing fees. Or pass on credit card processing fees to customers who choose to pay with cards.

Get StartedEmpower Your Business with Fee-Free Credit Card Processing

Fee Free Feature

Compliance and Risk Mitigation

Cost Savings

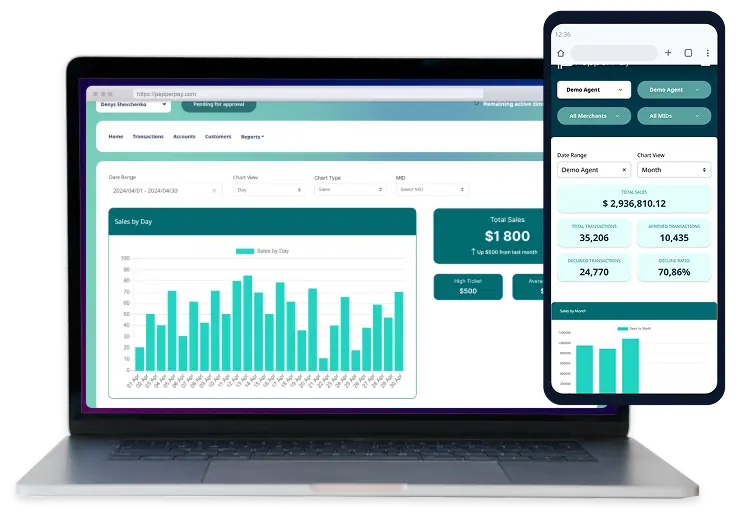

Financial Management and Reporting

Transaction Flexibility

No hidden risks. Stay fully compliant with federal, state, and card-brand requirements.

Substantially reduce processing costs.

Easy reconciliation with real-time reporting, and flexible configuration.

Accept credit and debit cards or ACH and eChecks, in-person or online, with full flexibility for your customers.

Compliance and Security

Pepper Pay keeps your business compliant with all federal, state, and card-brand rules. From customer notifications to transaction receipts, our platform automates compliance so you can run your business with confidence.

- Register with card brands

Our team manages required notifications for you.

- Customer signage

We provide guidance and access to signage.

- Surcharge ≤ 3%

Our system ensures surcharge never exceeds 3%.

- Surcharge + product processed together

Processed as one transaction.

- Receipt itemization

Receipts include required credit card fee details.

- No surcharges on debit

System automatically applies no fee on debit.

Cut Costs. Stay Compliant. Boost Revenue.

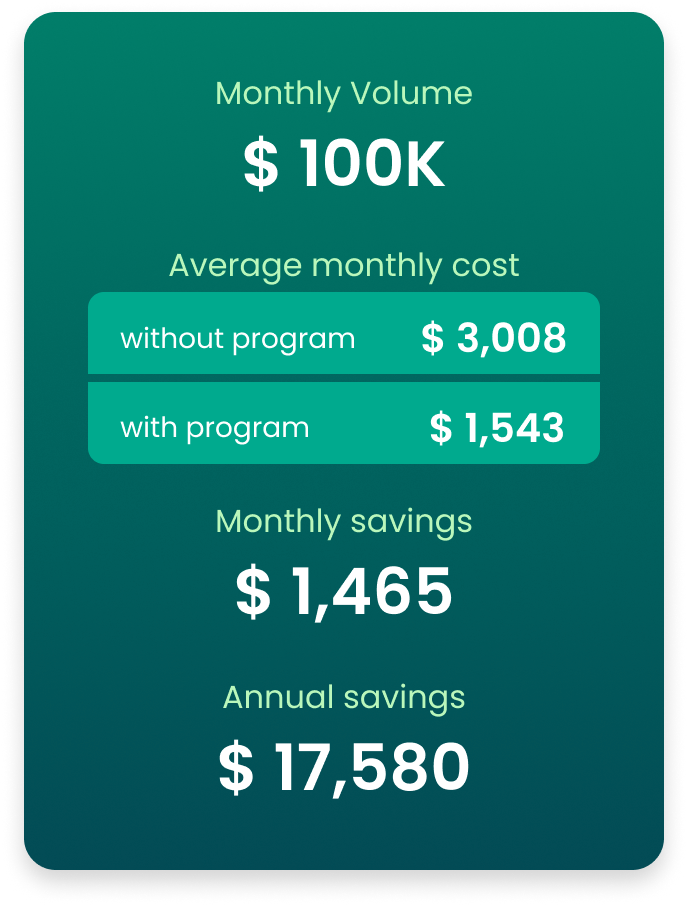

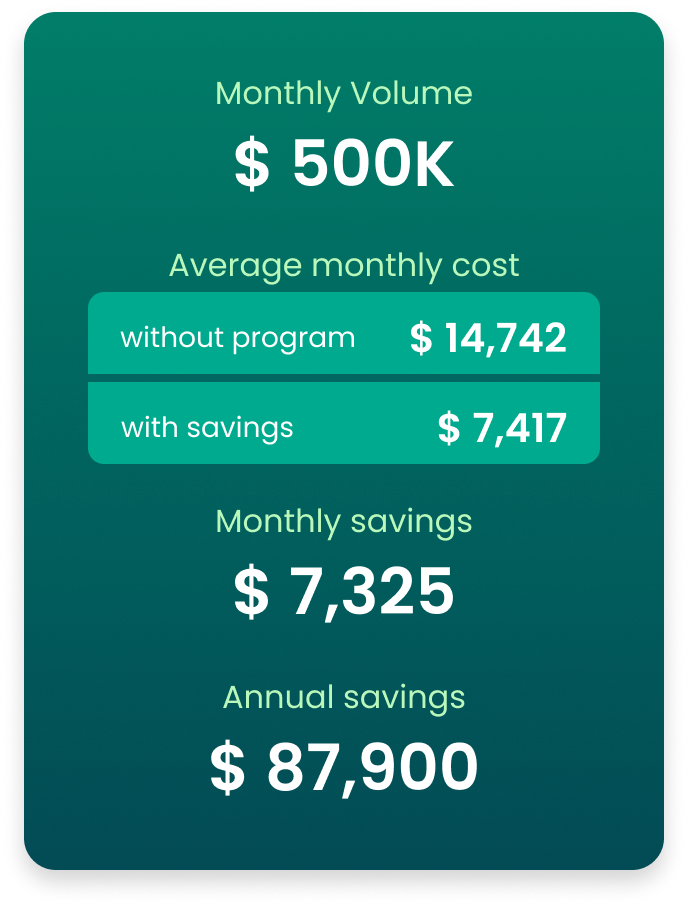

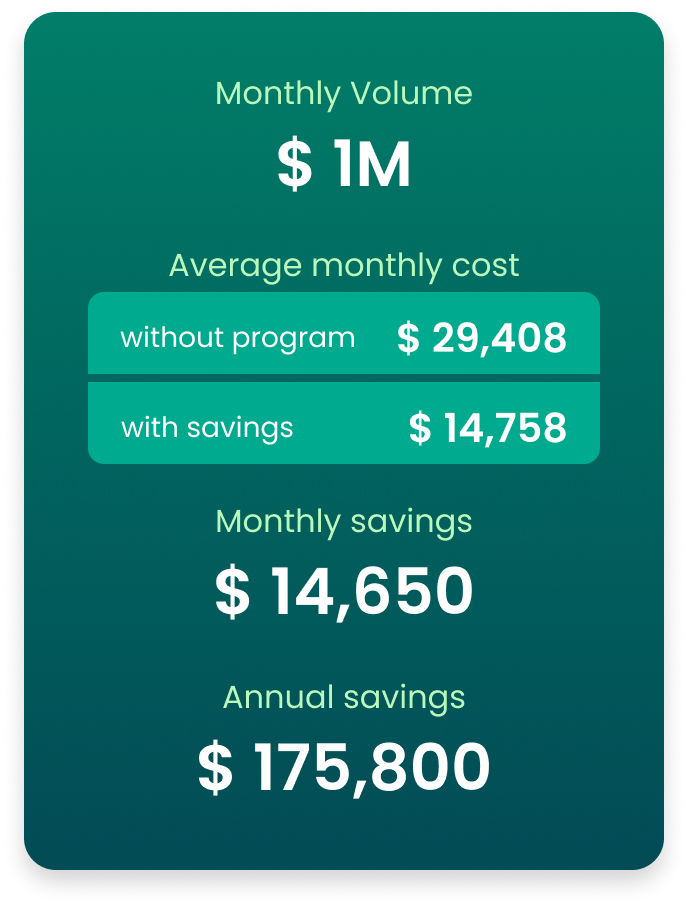

See how much you could save with Pepper Pay's programs.

* Based on the industry statistics.

** Savings examples are for illustration only; actual results depend on your specific business activity.